Commodity prices fell, and experts predict that it will be difficult to see a sharp decline in trend during the year

【Time:2021-10-25 14:03】 【Traffic:】

Since this year, affected by multiple factors, the prices of bulk commodities have increased significantly, and the prices of many varieties represented by non-ferrous metals, energy and chemical industry have reached a new high. Therefore, the topic of whether commodities will enter the "super cycle" is also gradually heating up.

Mingming, chief IFCC analyst of CITIC Securities, told the Securities Daily that the rising commodity prices were caused by many factors. First, the global liquidity flood has pushed up commodity prices; Secondly, the repair speed of global demand is faster than that of supply, resulting in a shortage of upstream commodity supply; At the same time, global demand has warmed up. Due to the timely control of the epidemic, China has become a global manufacturing and supply center, resulting in a large increase in the demand for domestic upstream bulk commodities, while the domestic supply capacity is limited, and is further constrained by dual control of energy consumption and safety and environmental protection inspection, resulting in a widening gap in the supply and demand of domestic bulk commodities; Finally, there was speculation in the market under the expectation of price rise, which further led to the rapid rise of bulk commodities.

At the same time, relevant departments attach great importance to the work of ensuring the price and stable supply of bulk commodities. From October 19 to October 22, the national development and Reform Commission issued ten documents emphasizing the work of ensuring the supply and price of coal, and putting in multiple batches of national reserves such as copper, aluminum, zinc and crude oil. Recently, it also made it clear that it would strengthen the monitoring and analysis of commodity prices, organize the investment of subsequent batches of national reserves, take multiple measures to increase market supply, and continue to strengthen the linkage supervision of the futures and spot market, Curb excessive speculation and maintain normal market order.

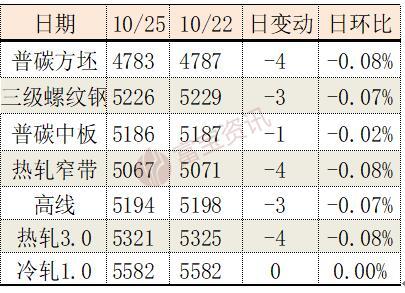

With a series of policy combinations, the prices of major commodities have been adjusted recently. The research report released by new era futures on October 22 shows that in just three or four trading days last week, the limit of power coal triple board fell by 32%, coking coal fell by 29% and coke fell by 26%, erasing all the gains in mid and early October. In the black industrial chain, rebar broke away from the high point in October, with a maximum decline of more than 19%. Among coal chemical products, ethylene glycol decreased by 19.6% and methanol decreased by 27%. In addition, PVC fell by 25%, ferrosilicon by 22.7% and soda ash by 18%.

"From the perspective of domestic futures prices, coal, steel, soda ash and other varieties have fallen sharply recently, mainly because the central government continues to strengthen measures to ensure supply and stabilize prices. For example, the national development and Reform Commission has made it clear that it will make full use of all necessary means stipulated in the price law to study specific measures to intervene in coal prices, so as to increase the market's expectation of gradual easing at the supply side in the future." Dong zhongyun, chief economist of AVIC securities, told the Securities Daily.

Looking forward to the later trend of bulk commodities, Dong zhongyun believes that based on the institutional advantages of high domestic administrative efficiency and strong policy implementation, the probability of domestic leading industrial product prices continuing to rise sharply is low, and the contradiction between supply and demand tends to gradually ease in the future. At present, the upward pressure on the prices of some major internationally dominated commodities is still large. Taking crude oil as an example, the change of supply and demand depends on the production increase of major oil producing countries and the withdrawal progress of stimulus policies of major developed countries. It is expected that there is still room for upward prices.

"In the short term, the introduction and implementation of the policy of ensuring supply and stabilizing price will restrain the disorderly rise of commodity prices to a certain extent. However, from the perspective of fundamentals, the gap between supply and demand of upstream commodities still exists. Although the expectation of continued rise of commodity prices can be alleviated to a certain extent with the expansion and release of upstream production capacity, it is still difficult to see a sharp trend decline." Mingming expects that next year, the demand of bulk commodities will gradually fall and the supply will gradually expand, and the price probability will gradually fall.

In Mingming's view, the effects of supply side policies such as ensuring supply and stabilizing prices are obvious. After the decline of commodity prices, it will reduce the inflationary pressure of the economy and make room for macro policy regulation. It should be noted that if the price of bulk commodities drops suddenly, it may aggravate the turbulence of the futures market. Therefore, it is necessary to prevent the chain reaction that may be caused by the sharp fluctuation of the price of the futures market, strengthen the supervision of the futures market, curb excessive speculation and eliminate malicious capital speculation, so as to return the futures price to price discovery and guide the positioning of the spot price.

"Whether it is rising or falling, excessive fluctuations in commodity prices in the short term will disrupt enterprise expectations and production arrangements." Dong zhongyun suggested that at the policy level, we should make medium and long-term industrial planning, strive to achieve the matching of supply and demand in the medium and long term, actively guide market price expectations and curb unreasonable price fluctuations in the short term through strict supervision. At the enterprise level, we should actively respond to price fluctuations and implement hedging with the help of financial market instruments to avoid the risk of price fluctuations. (Securities Daily)